It’s Our Background

That Puts Us Squarely in the Foreground

Senior Counsel Stanley M. Grossman arguing at the Supreme Court in 2008.

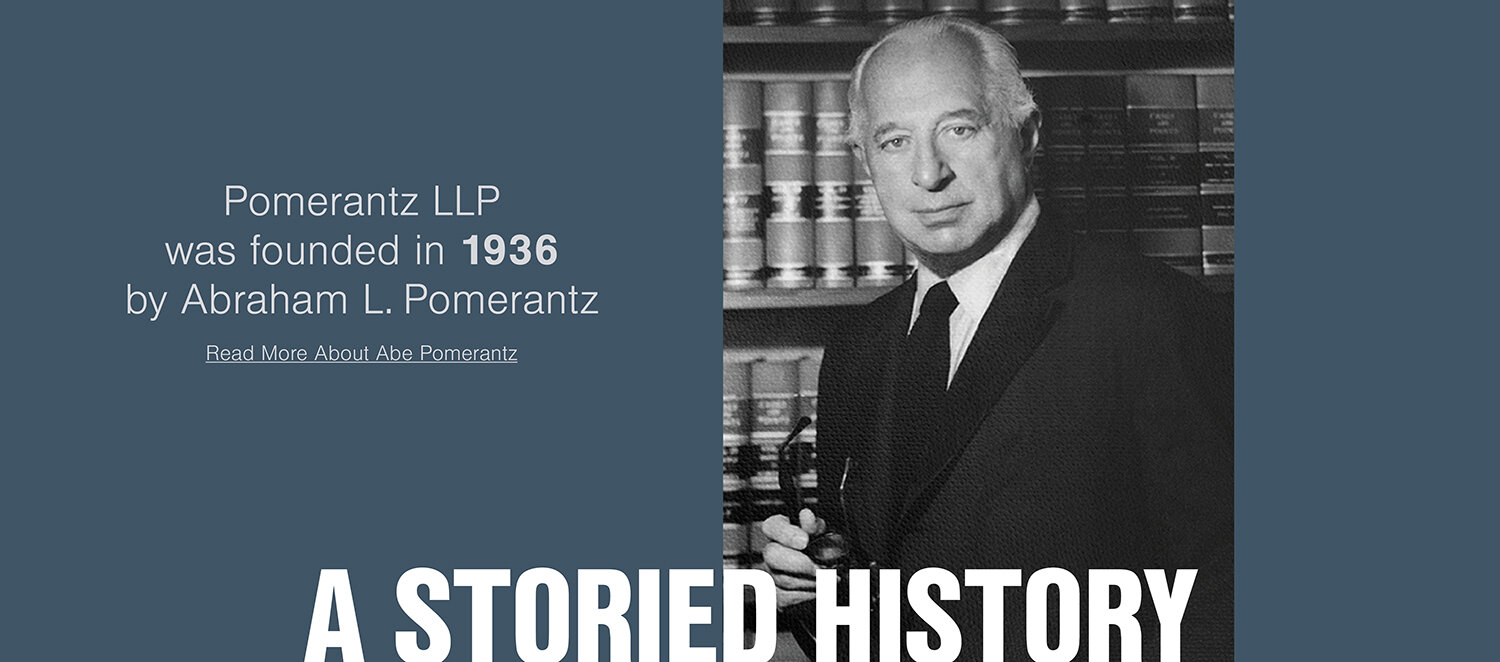

Since its founding by legendary attorney Abe Pomerantz in 1936, Pomerantz has continued to champion and expand shareholders’ rights with precedent-setting decisions and record-setting recoveries.

For over 85 years, the Firm’s attorneys have developed innovative legal theories to address the evolving legal, social, and corporate landscape. From Abe Pomerantz’s trailblazing work on behalf of defrauded investors in the 1930s, to our ground-breaking work post-Morrison, to advancing the interests of our clients, both foreign and domestic, irrespective of where they trade securities, to our novel litigation in the #MeToo era, Pomerantz remains at the vanguard.

As a result of litigation pursued by Pomerantz:

- shareholders have a right to a jury trial in derivative actions;

- purchasers of options have standing to sue under federal securities laws;

- when a court selects a Lead Plaintiff, the standard for calculating the “largest financial interest” must take into account sales as well as purchases;

- a temporary rise in share price above its purchase price in the aftermath of a corrective disclosure does not eviscerate an investor’s claim for damages;

- plaintiffs have no burden to show price impact at the class certification stage; and

- defendants seeking to rebut the Basic presumption of reliance on an efficient market must do so by a preponderance of evidence.

Senior Counsel Patrick V. Dahlstrom

The Firm’s victories over the past eight decades included billions of dollars recovered for defrauded investors. Many of these settlements set new records, including a $225 million recovery for the Class in In re Comverse Technology, Inc., which stands as the second-largest recovery to date involving the backdating of options. And, in ground-breaking litigation against Yahoo! Inc., Pomerantz won an $80 million settlement for the Class in 2018 -- the first significant settlement to date of a securities fraud class action filed in response to a data breach.

Senior Counsel Marc I. Gross

Pomerantz’s historic $3 billion settlement in 2018 in litigation against Brazil’s oil giant, Petrobras, shattered many previously held records for class action securities fraud litigation: it is the largest settlement ever in a securities class action involving a foreign issuer, the fifth-largest securities class action settlement ever achieved in the United States, the largest securities class action settlement achieved by a foreign Lead Plaintiff, and the largest securities class action settlement in history not involving a restatement of financial reports.

Today, led by Managing Partner Jeremy A. Lieberman, Pomerantz maintains the commitment to excellence and integrity passed down by our founder. With a focus on the future, attention to the present, and respect for the past, Pomerantz continues to uphold Abe’s dedication to protecting and defining shareholder rights through securities litigation, and the vigorous pursuit of corporate governance reform.

Managing Partner Jeremy A. Lieberman

Stanley M. Grossman and Marc I. Gross are former Managing Partners; Patrick V. Dahlstrom is a former Co-Managing Partner.